What is invoicing?

Invoicing is a record of a transaction between a buyer and seller, such as a paper receipt from a store or an online record from an e-tailer.

Generally, invoices detail payment terms, unit costs, shipping and handling, and any other details agreed upon during the transaction. If goods or services were bought on credit, the invoice often details the conditions of the transaction and details the various payment methods.

Why is manual invoice generation not ideal for modern businesses? In a manual system, humans make mistakes, thus faults are unavoidable. Duplicate payments, late fees, overpayments, fraud, missing discounts, and credit note issues are all frequent with manual invoice processing. You lose money and your company's bottom line suffers. If your company processes hundreds of invoices yearly, you can see how much time and money is wasted.

But thankfully, free online invoicing software is making it easy for small businesses to outsource work to automation. Most billing and invoicing software in UK has simple procedures for editing information, and they are handled in the same way that any other text document is modified.

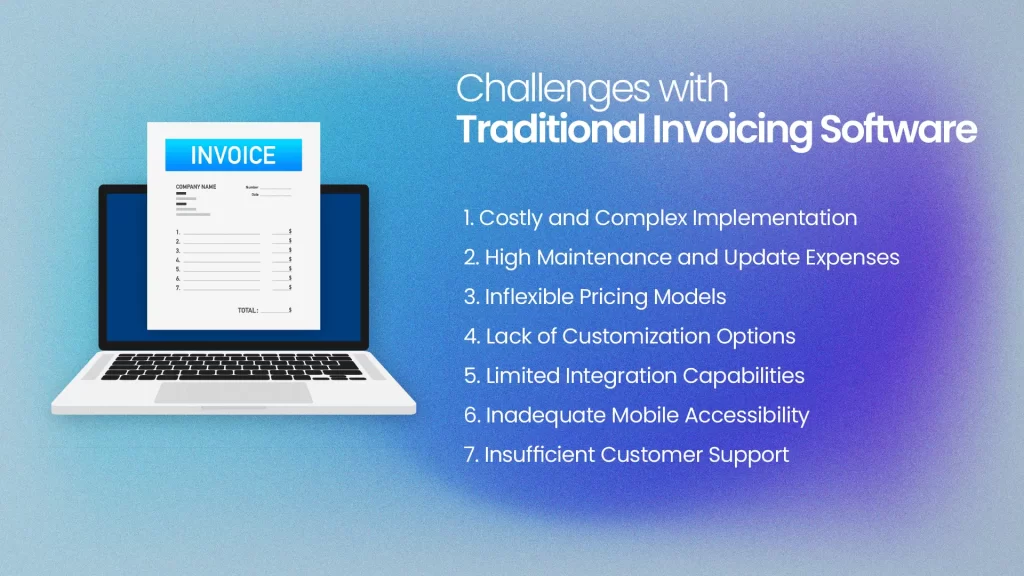

Challenges with Traditional Invoicing Software

- Costly and Complex Implementation

Traditional invoicing software often requires significant upfront costs, making it less accessible for small businesses with limited budgets. The installation and setup process of such software can be complex and time-consuming, requiring technical expertise that may not be readily available.

- High Maintenance and Update Expenses

Traditional invoicing software typically necessitates regular maintenance and updates, which can add to the overall cost burden for small businesses. These updates may require additional training or professional assistance, leading to further expenses.

- Inflexible Pricing Models

Traditional invoicing software often follows a one-size-fits-all pricing model, which may not align with the budget constraints of small businesses. The fixed pricing structure can be overly expensive for small businesses with lower invoice volumes, leading to unnecessary costs.

- Lack of Customization Options

Small businesses often require the ability to customize invoices to reflect their unique branding and identity. Traditional invoicing software may have limited customization options, restricting the ability to create professional and personalized invoices.

- Limited Integration Capabilities

Seamless integration between invoicing software and other business systems, such as accounting software or CRM platforms, is crucial for small businesses. Traditional software may not offer comprehensive integration options, leading to manual data entry, potential errors, and inefficiencies.

- Inadequate Mobile Accessibility

The rise of remote work and mobile operations necessitates the availability of invoicing software on various devices. Traditional software may lack mobile accessibility, restricting the ability to create and manage invoices on the go.

- Insufficient Customer Support

Small businesses often require prompt and reliable customer support to address any issues or queries related to invoicing software. Traditional software providers may not prioritize small business customers, resulting in slower response times or limited support resources.

5 Major Benefits of Online Invoicing Software for Small Businesses

There are a range of benefits of invoicing software for small businesses, making it an essential tool for optimizing their invoicing processes.

List of Benefits of Invoicing Software

- Saves time and reduces costs by eliminating paperwork and manual processes.

- Automates reminders, ensuring timely payments and reducing the need for manual follow-ups.

- Organizes and secures information, eliminating the reliance on scattered paper records and spreadsheets.

- Enables errorless recurring invoices, saving effort and minimizing the risk of inaccuracies.

- Provides anytime, anywhere access to invoices, improving convenience and efficiency for business owners.

Saves time, reduces cost

As a lot of paperwork is irritating and unreliable. Paper records require time to prepare and handle, which increases budgetary expenses.

Time is money! and everyone wants to save it. The online invoicing software for small businesses eliminates these repetitive processes and expenses for you. Online invoicing helps avoid the need for paper, envelopes, stamps, and all other manual work that require a lot of time and labor costs. Additionally, you do not require storage. This big change results in cost, time, and space savings for a business.

Send automatic reminders

Do you have to chase payments by calling clients and reminding them or sending emails again and again? Then invoicing software for small businesses seems like the right option for you!

Online invoicing reminders can assist in this matter. Set up automated notes and reminders for each client, including payment due dates. Because sometimes your customers may not mean any harm, they simply have too much on their plates and forget about deadlines. You no longer need to worry about due payments, because the software does everything for you. To ensure that you get paid on time, it acts as a virtual debt collector.

Want to know how automating your financial processes can further optimize your business operations? Check out our detailed blog on "Benefits of Accounting Automation”

Properly organizes and secures information

Keeping and Finding data in registers, paper invoices or spreadsheets stored on your laptop in different places is not easy and reliable to depend on.

Online invoicing allows you to keep all of your information in one place, rather than in a bunch of big stacks of paper. Also, your financial information remains safe and can not be misused with cloud-based invoicing software for small businesses.

This makes it easier than ever to keep track of and find information. Business owners can use these accounting tools to keep track of their receivables and payables, pay their sales tax, become MTD compliant, and be well-prepared for tax time or VAT returns in UK.

Send errorless recurring invoices

Manually creating and sending each invoice separately or again and again is such an effort-taking and error-prone task. If you have repeat clients that get recurrent services or products, create a recurring billing profile to automatically bill and charge them. Also when you are using online invoicing software for small businesses, you don't have to worry about missing data or incorrect figures.

Save a significant amount of time billing your customers online with automatically generated reliable invoices with just one click.

Access invoices anytime, anywhere

You may have encountered moments like having to send invoices or needing a particular invoice but you’re out of town. Such instances are frustrating and have a bad impact on your clients.

Invoicing software allows you to produce invoices from almost any place and send them directly to clients through email. Moreover, with cloud-based online invoicing, you can keep track of your clients and their payments all in one place. You can also look for information in them and find it whenever they want.

You don't have to be in your office to find, send, or do anything else with your invoices. You can do it all from your laptop anywhere, anytime. Invoicing software for small businesses only needs to be connected to the internet. Imagine being able to see invoice data from anywhere, even on your smartphone.

Move to Simplicity and Professionalism!

Invoices are a vital component of internal controls and audits in accounting, and as a company expands, producing and handling invoices gets increasingly difficult. As invoicing software for small businesses contains all client and sales information, creating invoices or bills is quick and easy. Determining and matching all potential credentials manually might take a long time.

If you want reliable invoicing software, you can always rely on Moneypex accounting software, which is the best accounting and invoicing app or software for small businesses, recognized by HMRC easing you to file your VAT returns online in UK.

Moneypex’s smart scanning feature automatically extracts information from handwritten or printed receipts, fills data in built in invoice templates, and generates professional, errorless invoices. You can send these invoices to clients via email.

Moreover, you can set up automated notes and payment reminders for each client. It’s a one-stop shop for fixing issues by providing you with the right solutions for all invoicing problems.

FAQs

Which software is best for making invoices?

Moneypex is an excellent choice for making invoices. It is an online invoicing software for small businesses. With its user-friendly interface, robust features, and customizable templates, Moneypex simplifies the invoicing process, enhances accuracy, and helps you manage your business finances efficiently.

How do I set up invoicing for my small business?

Setting up invoicing for your small business with Moneypex is quick and easy. Simply sign up for an account on the Moneypex website, and you'll gain access to a range of invoicing features. Customize your invoice templates with your business logo and details, set up your payment terms and methods, add your products or services, and you'll be ready to create professional invoices in no time.

Is Excel or Word better for invoices?

While Excel and Word can be used for basic invoicing needs, they lack the advanced functionalities and automation capabilities provided by dedicated online invoicing software for small businesses like Moneypex. Excel and Word require manual data entry and calculations, making them more time-consuming and prone to errors. Moneypex streamlines the process by automating calculations, tracking payments, and generating professional-looking invoices effortlessly.

Is Excel good for invoicing?

Excel can be suitable for invoicing if you have a limited number of invoices and simple invoicing requirements. However, as your business grows, manual invoicing in Excel becomes cumbersome and inefficient. Online invoicing software for small businesses like Moneypex offers scalability, customization, automation, and better overall management of your invoicing process.

Can I create an invoice myself?

Absolutely! With Moneypex, you can easily create invoices yourself without any technical expertise. The software provides a user-friendly interface where you can enter your business information, add line items for products or services, specify quantities and prices, apply taxes or discounts if needed, and generate a professional invoice ready to be sent to your clients.

How to do your own invoicing?

To do your own invoicing using Moneypex:

- Sign up for Moneypex account or log in.

- Customize your invoice template with your logo and business details.

- Add your products or services along with their prices and descriptions.

- Enter client details for whom you're creating the invoice.

- Preview the invoice to ensure accuracy.

- Send the invoice to your client via email directly from Moneypex or download and print it if needed.

How do I create a free business invoice?

Moneypex offers a free plan that allows you to create business invoices without any cost. Simply sign up for the free trial on the Moneypex website, and you'll have access to essential invoicing features to generate professional invoices. Upgrade options are available if you need additional functionalities or require higher usage limits.

Why do we need invoicing software?

Invoicing software is vital for small businesses as it simplifies the invoicing process, streamlines financial record-keeping, enhances professionalism, automates recurring invoices, and improves cash flow management. By saving time, reducing errors, and facilitating prompt payment, it becomes an indispensable tool for small business success.

Moneypex

Moneypex team is here to give you the best tips for starting, running, or growing your small business. Written for self-employed individuals and small business owners, Moneypex provides insights into the latest trends and expert advice.